Understanding Runaway Gaps (Continuation Gaps) in Binary Options Trading

Runaway gaps in binary options signify a significant price leap, driven by intense market interest and often occurring during strong trends. These gaps, unlike other types, indicate continued momentum, providing ample trading opportunities.

What is a Runaway Gap?

A runaway gap represents a leap in pricing on a market chart, skipping sequential price points amidst high trading volumes. Such gaps usually emerge after breakaway gaps during strong market trends.

Strong Market Conditions for Runaway Gaps

Runaway gaps thrive in robust market conditions where traders who missed initial movements jump in, influenced by prevailing trends. This mass participation further strengthens the trend.

Example 1: Tesla's Runaway Gap (2020)

In 2020, Tesla experienced a notable runaway gap due to overwhelming investor enthusiasm, reinforcing its upward trend.

Example 2: S&P 500 Runaway Gap (2022)

The S&P 500 witnessed a significant runaway gap in 2022, primarily fueled by economic recovery signals post-pandemic.

How Runaway Gaps Reinforce Market Sentiment

Runaway gaps bolster market sentiment by indicating ongoing trend strength, often following key news events or shifts in investor behavior.

Characteristics of Runaway Gaps

- High trading volumes

- Part of a continuing trend

- Infrequently filled quickly

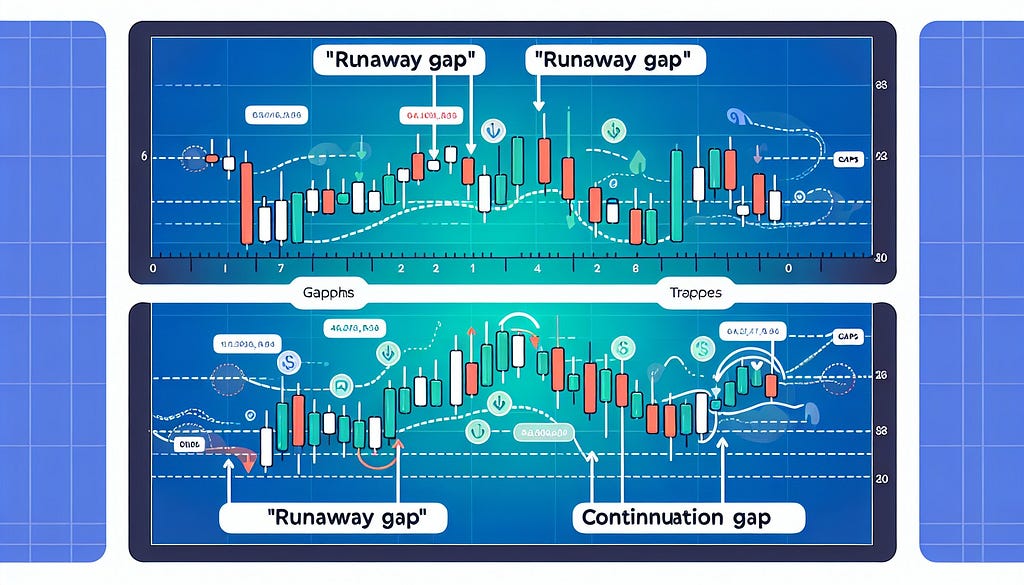

Difference Between Runaway Gaps and Other Gaps

Understanding different gap types is crucial for traders. Here's how they differ:

Breakaway Gaps

Breakaway gaps appear at the start of a new trend. An example is Amazon's breakaway gap in 2018, marking its entry into a bullish phase.

Exhaustion Gaps

Exhaustion gaps usually signal the end of a trend. Bitcoin's exhaustion gap in 2021 served as a warning for a trend reversal.

Key Differences Between Gap Types

- Runaway Gaps: Continuation signals

- Breakaway Gaps: Initiate trends

- Exhaustion Gaps: End of trends

Impact on Price Action

Runaway gaps significantly affect price action by creating new support or resistance levels, guiding traders in making informed decisions.

Identifying Runaway Gaps Using Candlestick Patterns

Candlestick patterns are effective indicators of runaway gaps, aiding traders in pinpointing potential trading opportunities.

Common Candlestick Patterns that Precede Runaway Gaps

Look out for patterns like Doji and Marubozu, which often herald the formation of runaway gaps.

How Candlestick Patterns Support Runaway Gaps

These patterns provide visual cues on investor sentiment, indicating strong market moves that lead to runaway gaps.

Trading Strategies Based on Candlestick Patterns and Gaps

Integrating candlestick analysis with gap identification enhances trading strategies, confirming trends and improving entry/exit timing.

Leveraging Runaway Gaps in Binary Options Trading

Runaway gaps in binary options offer unique opportunities as outcomes are predetermined, simplifying decision-making.

Using Runaway Gaps to Confirm Trends

Gaps serve as powerful confirmation signals, strengthening traders' confidence in ongoing trends.

Timing Entries and Exits

Accurate timing of trades is vital. For Forex, consider expiration times of 5-8 hours; for stocks, aim for the session close.

Risk Management

Effective risk management involves placing stop-loss orders strategically at new support or resistance levels created by gaps.

Case Study: Applying Price Action and Runaway Gaps

Initial Price Action Analysis

Begin by closely analyzing price action, identifying potential gaps that align with strong market trends.

Choosing the Right Expiration Time

Select an expiration time based on the asset type and anticipated trend duration to maximize profit potential.

Result: Profitable Trade

By following strategic indicators and timing, traders can achieve successful outcomes in binary options trading.

How to Incorporate Runaway Gaps into Your Trading Plan

Step 1: Monitor Price Action Closely

Regularly track market charts to identify emerging gaps indicative of strong trends.

Step 2: Combine Gaps with Candlestick Patterns

Use these patterns to confirm and predict potential gap formations within market trends.

Step 3: Use Proper Risk Management Techniques

Implement disciplined risk management strategies to protect investments against volatile market movements.

Conclusion

Mastering runaway gaps in binary options enables traders to leverage significant price movements effectively. By understanding their formation and using technical analysis tools, traders can enhance their trading strategies and navigate markets successfully.

For more insights, check out this comprehensive video guide and visit Binary Options Strategy on Facebook for daily updates. Also, explore detailed resources available on Ben Huebn.

Keine Kommentare:

Kommentar veröffentlichen