Price Action Strategy for Beginners: Analyzing Price at Fibonacci Levels

Price action trading is a method that analyzes market movements to identify trade signals based on price movements. It hinges on understanding demand and supply, which manifest as support and resistance levels, and on identifying trends using higher highs and lower lows.

Understanding Fibonacci Levels in Trading

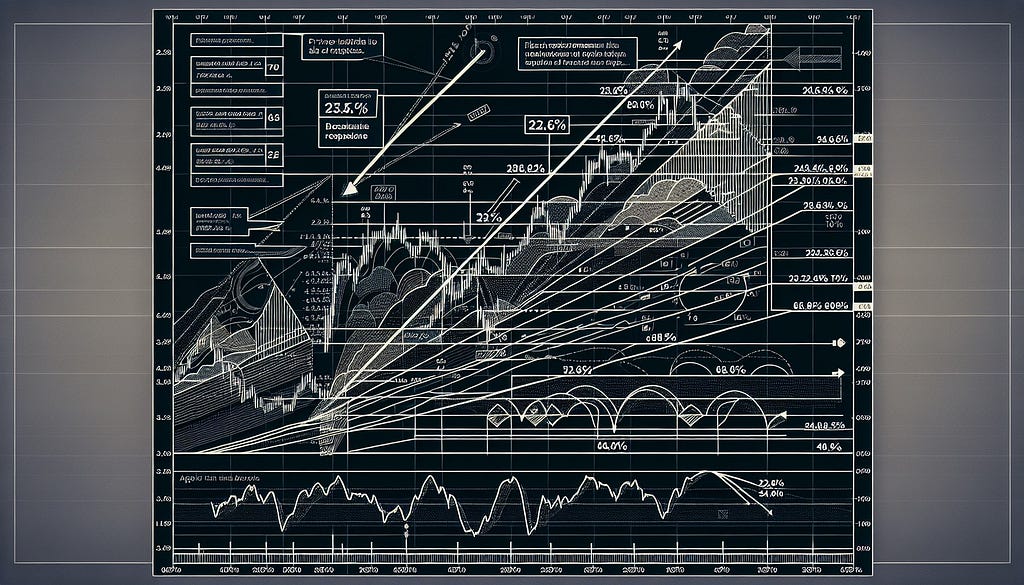

Fibonacci levels are integral in technical analysis, helping traders pinpoint potential reversal points by identifying key support and resistance. These levels, derived from the Fibonacci sequence, are used to forecast potential areas of retracement by marking percentages such as 23.6%, 38.2%, 50%, and 61.8%.

The Origin of Fibonacci Levels

The Fibonacci sequence originates from a mathematical series where each number is the sum of the two preceding numbers. In trading, the percentages derived from this sequence help project market behavior.

Sign up for FREE on Pocket Option and practically understand these concepts with a demo account.

Fibonacci Retracement Levels in Price Action

Retracement levels are crucial in a price action strategy for beginners. They help traders identify potential entry and exit points within a trend by marking natural zones where prices may reverse.

How Fibonacci Extensions Work

Beyond retracement, Fibonacci extensions like 161.8% offer additional price targets in trend continuations. These levels serve as potential profit-taking points.

Applying Price Action Strategy at Fibonacci Levels

Support and resistance are pivotal when paired with Fibonacci levels, creating zones for informed decision-making.

Recognizing Price Reactions at Key Fibonacci Levels

Identifying how prices react at Fibonacci levels is key. Patterns like the pin bar and inside bar at these levels may indicate a strong trade setup.

Using Support and Resistance with Fibonacci Levels

Fibonacci interacts with support and resistance to create zones of interest. Traders often watch for price reactions at these intersections to strategize entry and exit points. Learn more about support and resistance in trading.

Placing Trades Using Fibonacci Levels and Price Action

Combining Fibonacci with price action strategies allows traders to develop a balanced approach to trade setups, enhancing their precision and success rate.

Key Tools for Analyzing Fibonacci Levels with Price Action

Trend Lines and Fibonacci Confluence

Using trend lines with Fibonacci levels, known as confluence, increases the probability of identifying robust trade setups. This enhances the confidence in pursuing trades based on their signals.

Candlestick Patterns at Fibonacci Levels

Candlestick patterns provide additional confirmation. For instance, a doji or hammer at a Fibonacci level might suggest a reversal opportunity.

Moving Averages with Fibonacci

Aligning moving averages with Fibonacci levels validates potential entry or exit points, providing further confidence in trade directionality. Understand more through live trading sessions.

Real-World Examples of Fibonacci Levels and Price Action

Forex Market: Fibonacci and Price Action in Action

In Forex, trends can be supported by Fibonacci levels, guiding traders on potential entry points or reversals during significant movements like a EUR/USD trend.

Stock Trading: How to Spot Reversals at Fibonacci Levels

Spotting trades in the stock market involves watching for reversals at Fibonacci levels. Traders use these as cues for potential buying opportunities.

Binary Options: Precision with Fibonacci and Price Action

In binary options, precision is paramount. Leveraging Fibonacci provides clear markers, allowing for precise short-term trading predictions. Sign up on OlympTrade for free and start with demo trading.

Advanced Techniques for Fibonacci Level Analysis

Combining Fibonacci with Elliott Wave Theory

Integrating Elliott Wave Theory with Fibonacci offers a comprehensive forecasting tool, allowing market phase identification for better entry and exit strategies.

Setting Stop Losses Using Fibonacci

Stop-loss orders placed just below Fibonacci retracement levels help manage risk effectively, minimizing premature stoppage in trending markets.

Multi-Timeframe Analysis with Fibonacci Levels

Implementing multi-timeframe analysis helps uncover support or resistance across various timeframes, aligning trades with overall market trends.

Conclusion: Making the Most of Fibonacci Levels in Price Action Strategy

Fibonacci levels, when combined with a price action strategy, equip traders with powerful tools for identifying optimal entry and exit points. Consistency in applying these tools is crucial for trading success. Regular review and adaptation of strategies ensure continuous improvement. Stay updated through our YouTube Channel for live trading insights.

Keine Kommentare:

Kommentar veröffentlichen